Payroll & Invoicing Solution for US Staffing Companies

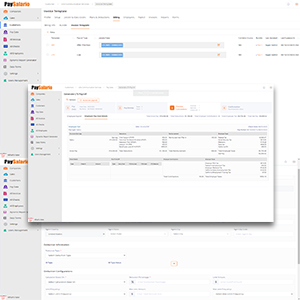

Invoicing: Invoice your customer per jobsite or location for administration fees, check processing fees, w/c, garnishments, health program fees and much more.

Automated Tax Calculations: Automated tax calculation features that ensure accurate tax withholdings based on the latest tax regulations and employee data.

Direct Deposit and Payments: Options for direct deposit and digital payment methods to facilitate seamless and secure salary distribution.

Tax Filing and Compliance: Automate tax filing processes, generate necessary tax reports/forms and assist in ensuring compliance with tax laws.

Garnishment and Benefits: Manage garnishments, deductions, and benefit contributions accurately and efficiently.

Comprehensive Reports: Ready payroll and invoice reports for ease of use. Customize and schedule reports.

Solution Features

- Unlimited Customers and Employees: Process payroll for any number of customers and any number of employees, seamlessly handling the entire payroll cycle.

- Seamless Payroll Migration: Transition your payroll ecosystem with ease, ensuring data integrity and error-free transfer from to PaySalario Solution. Migrate YTD, PTP Balance and start running payroll from any pay frequency.

- Location Specific Payroll Management: Navigate intricate state regulations, ensuring payroll precision while adhering to diverse regional standards.

- Multi-State Tax Calculation: Navigate multi-state employment complexities, automating calculations and minimizing tax-related complexities.

- Employee Checks, Paystubs and Payments: Pay via checks or EFT or both to employees, secured via Positive Pay and NACHA file, email pay stubs, view garnishment, benefit and deduction history per payroll per employee.

- Employee Service Portal: Employee get access to their payroll, pay data, pay stubs and much more.

- Garnishment Checks and Notification: Effortlessly achieve legal compliance with automated notifications for court-ordered garnishments, ensuring precise deduction of funds from an employee’s pay. No more manual intervention required.

- Benefit Administration: Configure Pre-tax, post-tax and custom benefits with eligibility and optional employer contribution.

- W/C Rates and Class Code Management: Optimize Workers’ Compensation administration, reducing administrative workload.

- Comprehensive Pay Type Management: Accurate and hassle-free payment disbursement, supporting multiple pay types like commission, covid, tips, salary, COVID pay, bonus, overtime, double time and custom pay types.

- Insurance Carrier Restrictions: Navigate limitations imposed by insurance companies on coverage provided to policyholders.

- Federal Tax Calculation: Automatically calculate federal taxes based on employee data, staying up-to-date with changes to federal tax laws.

- Timesheet Integration: Streamline timesheet data management, automating data import and reconciliation for accurate payroll computation. Import live time sheets and after the fact timesheets in horizontal and vertical formats. Increase efficiency by automating the process of entering time and attendance data.

- Automated Payroll Reports: Experience hands-free report generation, ensuring timely access to essential payroll data. Customize, configure and schedule reports.

- Reimbursements & Deductions: Efficiently manage financial dynamics, reducing administrative overhead and ensuring accuracy.

- Automatic Minimum Wage Updates: Stay compliant with minimum wage regulations, ensuring consistent adherence without manual intervention.

- Customer Invoicing & Multi-Jobsite Billing: Streamline invoicing based on jobsites or states, optimizing financial management. Multiple billing templates per state or jobsite or combinations of multiple jobsites and states.

- Invoice Reports for Transparent Billing: Generate comprehensive reports for transparent billing processes, ensuring accurate financial analysis and compliance monitoring.

- Post-Payment & Aging Reports: Take control of post-payment analysis and aging, empowering informed financial decisions and maintaining a healthy billing cycle.

- Data Exchange: Effortlessly harmonize data flow between systems, maintaining consistency during transitions or updates. Easily import and export all data.

- Cloud or On-Premises Deployment: Tailor deployment to your infrastructure preferences, ensuring data security and accessibility.

- Recurring Payroll: Simplify regular, recurring payment schedules, minimizing errors.

- Role-Based Access Control (RBAC): Elevate data security and user management with granular definition of user roles, ensuring confidentiality, compliance, and streamlined operations.

- Bulk Emails & Templates: Enhance communication precision with automated bulk email capabilities, integrated with regulatory compliance.

- History Tracking: Gain comprehensive insights into payroll evolution, enabling auditing, historical analysis, and data-driven decision-making.

- Customization for Your Business: Adapt the platform to your unique business needs, from pay structure, benefits, deductions, PTO, billing templates, employee checks and much more.

- Custom Branding: Incorporate your brand identity into payroll documents for a consistent, professional image.

- Comprehensive Reporting: Unlock payroll insights with dynamic reports, aggregating compensation data, deductions, taxes, and benefits.

- Dynamic Report Builder: Craft bespoke payroll insights, tailor data fields, implement filters, and visualize data as per your unique requirements.

- Customize and Schedule Payroll Reports: Tailor payroll reports based on your specific requirements and automate their generation.

- PTO Management: Simplify PTO calculations and disbursements, enhancing employee satisfaction, retention, and productivity.

- Secure Payment Methods: Choose from flexible and secure payment options, ensuring safety with features like Positive Pay or NACHA file generation. Positive pay configuration specific to banks.

- Integrated HealthCues Program: Invest in employee well-being with our wellness initiative embedded within the payroll system.

- Generate Employee Forms – I9, W4: Simplify compliance with automatic generation of essential employee forms, reducing administrative burden.

- Sales and Broker Commission Management: Streamline commission management within the payroll system, ensuring accuracy.

Get Started

Utilize our ready solution

- Checkout our ready solution

- Map your business needs

- We customize and integrate with your existing system

- Start using your custom branded cloud hosted solution

Utilize our technology services

- HCM application services

- Remote teams with experience in HCM

- Mobile Applications

- Analytics and Reporting

- Integration with 3rd Party

Technology Services

We elevate your Human Resources with comprehensive applications, automated payroll software, remote expert teams, and advanced technologies including AI, cloud solutions, mobile apps, analytics, and blockchain security.